Ga take home pay

Salary Calculation for 130k. Well do the math for youall you need to do is enter.

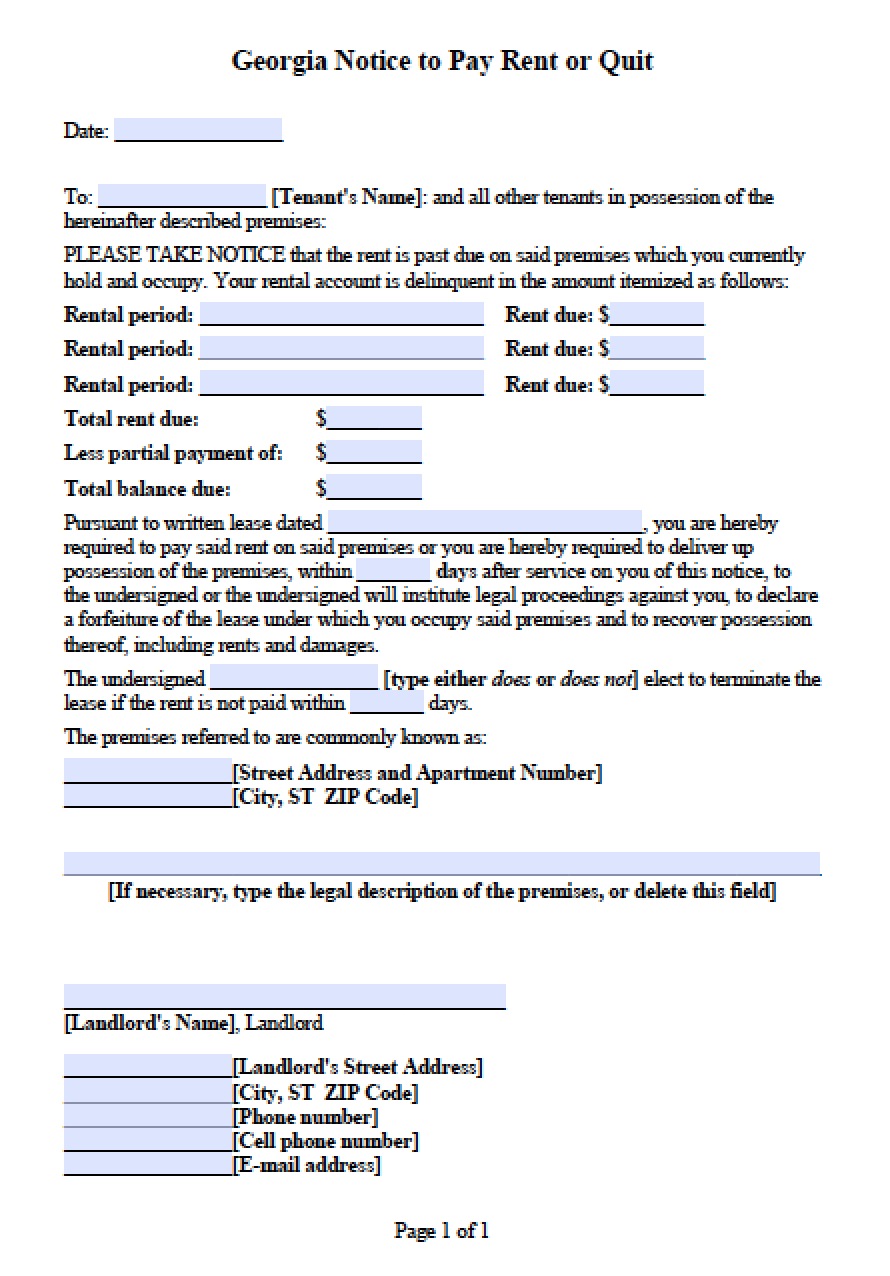

Eviction Notice Late Rent Notice Rent

The Georgia Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Georgia State.

. It can also be used to help fill steps 3 and 4 of a W-4 form. Yearly Monthly 4 Weekly 2 Weekly Weekly Daily Hourly 1. This is your actual take-home pay if you make 200000 in Georgia.

California also has a low take-home pay rate due in part to having the nations highest income tax rate. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Paycheck Results is your gross pay and specific deductions from your paycheck Net Pay is.

Calculating your Georgia state income tax is similar to the steps we listed on our Federal paycheck calculator. State income tax picks off 551 of that six-figure pay. Georgia Hourly Paycheck Calculator.

The Georgia bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding. To wrap it all up there will be a quick comparison between the take home pay from the year before so you can see how much what you take home has changedTake Home Pay. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

A 100000 salary drops to an estimated 70586 in take-home after federal and state taxes. This free easy to use payroll calculator will calculate your take home pay. Salary Calculation for 65k.

While Georgia has one of the lowest statewide. So the tax year 2022 will start from July 01 2021 to June 30 2022. Georgia Salary Paycheck Calculator.

The results are broken up into three sections. Yearly Monthly 4 Weekly 2 Weekly Weekly Daily Hourly 1. Georgia Salary Calculation - Single in 2022 Tax Year.

Supports hourly salary income and multiple pay frequencies. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. In Georgia taxpayers can claim a standard deduction of 4600 for single filers and 6000 for joint filers.

For 2022 the minimum wage in Georgia is 725 per hour. For example if an employee earns 1500. Below are your Georgia salary paycheck results.

Calculate your Georgia net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and. Use our take home pay calculator to determine your after-tax income by entering your gross pay and additional details. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Georgia. Georgia Salary Calculation - Single in 2022 Tax Year. But Georgia doesnt have.

Hourly employees who work more than 40 hours per week are paid at 15 times the regular pay rate. How to calculate annual income.

Our 11 X 17 Size Recycling Poster Ronald Mcdonald House Charities Pop Tabs Ronald Mcdonald House

Xwfqz0hzwekvfm

Bring The Kids For The Finart Program Photos Courtesy Of Blue Pelican Money Smart Family Money Smart Week Financial Education

Johns Creek Residence 4650 Candacraig Alpharetta Georgia Dream Kitchens Design Luxury Kitchens Modern Dream Kitchen

C Qne6f V6ln3m

How Much You Must Earn To Afford A House In The 50 Largest U S Cities Rits Map Home Buying City

Pay Dirt Cake Recipe Dirt Cake Desserts Pudding Flavors

Pay Dirt Cake Recipe Dirt Cake Cake Tasting Pudding Flavors

Pay Dirt Cake Recipe Dirt Cake Food Processor Recipes Cake Tasting

Tour Of A Craftsman Home In Atlanta Ga Craftsman Home Interiors Craftsman Home Decor Bungalow Decor

15 Best Flea Markets In Georgia Best Vacations Fleas Paris Travel

Pin On Best Of Hearmefolks Make Money Online

Pin By Muhammad Sumitra On Slip Gaji Nama Transportasi

Income Inequality In The Us How Much More The Top 1 Makes Compared To Everybody Else Vivid Maps Map Inequality Everybody Else

Georgia Considers Limits On College Course Payments Savannah Morning News Lease Agreement Sell Your Business Lease

Free Addition Games For The Classroom Or Home Learning Free Math Games Teaching Math Facts Math Facts

13 Legitimate Work From Home Jobs In Georgia Work From Home Jobs Legitimate Work From Home Home Jobs