Additional lump sum payment mortgage calculator

Conversely if you could get a return on your money of 6 by investing it you can see by using our convenient Present Value Calculator that 4212 received today would have the same value as receiving 1000 a year for 5 years. Lets assume you make a one-time lump-sum payment of 1000.

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Th mortgage payment each year.

. Make a One-Time Lump-Sum Contribution. Another payment strategy you can do is to make a large lump-sum payment. Your mortgage payment is defined as your principal and interest payment in this mortgage payoff calculator.

Add extra dollars to every payment. 4 Ways to Pay Off Your Mortgage Early. Lump Sum at Variable Rate.

The variable rate lump sum payout allows you to take a lump sum at closing and you can withdraw additional funds after 12 months. You can get a lump sum after receiving inheritance benefits or a windfall from a business venture. Both the principal and interest amounts decrease over time whether you make payments on the 1st 15th or a date in between.

These additional payments reduce the outstanding balance of a mortgage resulting in a shorter mortgage term. Maintain these additional payments over an extended period of time and youll likely eliminate several years from your term. By adding 300 to.

Lump-Sum Payments. You can use a lump sum extra payment calculator to calculate how much money you can save with a lump sum payment. The earlier a borrower makes prepayments the more it reduces the overall interest paid typically leading to quicker mortgage repayment.

The decision between cash up front and payments over time mostly depends on the interest rate that you can earn on money that you save and the difference between the lump sum amount and the annuity amount. Apply a lump sum after an inheritance or other windfall. A quick note here.

Extra lump sum payment calculator. It immediately reduces your principal compared to diminishing it in monthly increments. Make an extra mortgage payment every year.

If you can make lump-sum payments on your mortgage it will reduce the principal balance reducing the time to pay off your mortgage loan which allows you to save on interest. If you want a fixed interest rate this is your only available option. The loan is secured on the borrowers property through a process.

Lump Sum at Fixed Rate. Predetermined Lump Sum Paid at Loan Maturity. You can make a lump sum payment once a year.

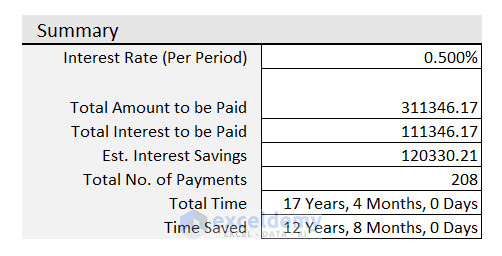

Since the inception of the industry more than 200 years ago beneficiaries have traditionally received lump-sum payments of the proceeds. The savings interest rate that you designate is used to calculate present value for the annuity payment option and is compounded monthly. If you are a Scotiabank mortgage customer depending on the mortgage solution that you select each year you can increase your scheduled monthly payments by up to 10 15 or 20 of the payment initially set for your term or in some cases your current payment and make a lump sum prepayment of up to 10 15 or 20 of your original principal.

This is the best option if you plan on using the calculator many times over the. Your repayment agreement with your Mortgage Lender will not alter if you make a lump sum payment but it will dramatically cut the amount of interest paid throughout the life of. This calculator will help you to measure the impact that a lump sum repayment made at a certain period into the loan will have on the length of your mortgage and the total interest paid.

Making a lump sum payment particularly in the early years of your loan can have a big effect on the total interest paid on the loan. If you do this each year you can significantly reduce your term and interest charges. An added lump sum payment has the greatest impact if you pay it soon after taking your mortgage.

You decide to make an additional 300 payment toward principal every month to pay off your home faster. If you make one entire additional mortgage payment per year with a bi-weekly payment schedule it. Interest rates on such loans are fixed for the entire loan term both of which are determined when the second mortgage is initially.

A home equity loan commonly referred to as a lump sum is granted for the full amount at the time of loan origination. We also offer three other options you can consider for other additional payment scenarios. There are several ways to prepay a mortgage.

Second mortgages come in two main forms home equity loans and home equity lines of credit. So while making a lump sum payment that amount wont make your monthly payments go down but it will help shorten the term length of your loan. For example lets assume you have 50000 in student loans at a 7 interest rate.

Your Mortgages Extra and Lump Sum Calculator will ask you to provide a few important pieces of information for it to perform its number-crunch. There is no best day of the month to pay your mortgage. Well show you how to pay off your mortgage faster so you can finally join the ranks of debt-free homeowners.

This kind of loan is rarely made except in the form of bonds. Well time is money and you could invest the 5000 lump sum and parlay it into additional revenue. Mortgage Calculator exe file - click the link and immediately run the mortgage calculator.

This calculator allows you to enter an initial lump-sum extra payment along with extra monthly payments which coincide with your regular monthly payments. While most homeowners only make 12 payments annually you can make a lump sum payment equivalent to a 13th payment on your mortgage. The lump sum loan payment shows that you can save 850 on your student loans and.

Consider a lump sum. You must take a one-time payment at closing with no additional disbursements. If you get an unexpected bonus from work or an inheritance you can quickly apply it toward the principal owed on your home.

- Take advantage of lump-sum payments. Make payments weekly biweekly semimonthly monthly bimonthly quarterly or. Annual Lump Sum Equal to a 13th Payment.

Okay you probably already know that every dollar you add to your mortgage payment puts a bigger dent in your principal balance. Youll pay down your loan early by 3 years and 9 months. Applying an Extra Lump Sum Payment.

Second mortgage types Lump sum. A prepayment is a lump sum payment made in addition to regular mortgage installments. Mortgage Calculator zip file - download the zip file extract it and install it on your computer.

Use this additional payment calculator to determine the payment or loan amount for different payment frequencies. Unless you choose to get a refinance mortgage loan your recurring monthly mortgage payment will remain the same even if you submit an additional payment or lump sum. ¹ Note 1 - Take advantage of increased payment options or choose a shorter amortization period.

The default payout option of most. This is the best option if you are in a rush andor only plan on using the calculator today. A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged.

Extra Mortgage Payments Calculator. An easy way to make your money work for you is to put it towards your mortgage in additional and lump-sum payments. Some loans such as balloon loans can also have smaller routine payments during their lifetimes but this calculation only works for loans with a single payment of all principal and interest due at maturity.

When you pay extra on your principal balance you reduce the amount of your loan and save money on interest. Extra Mortgage Payment Calculator 47.

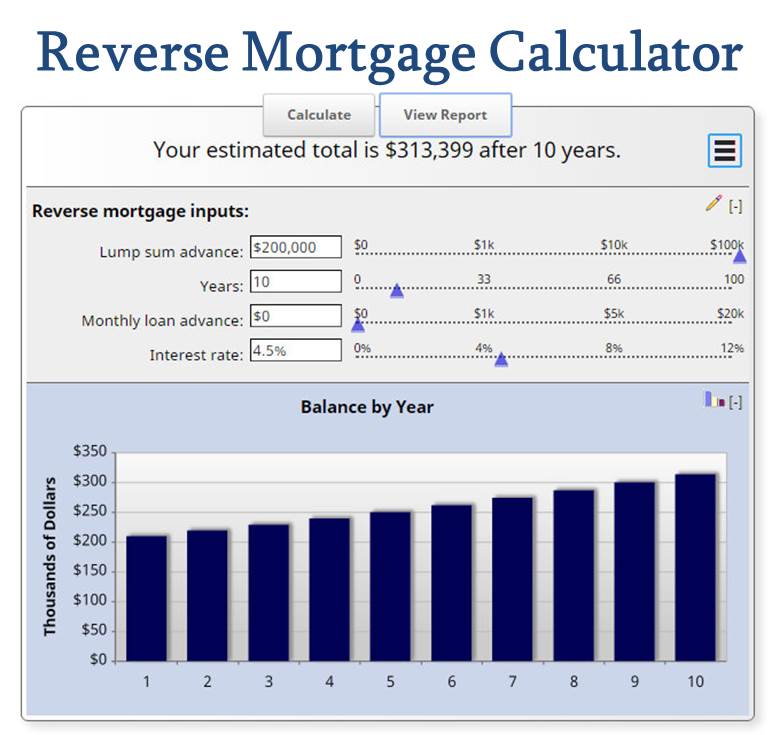

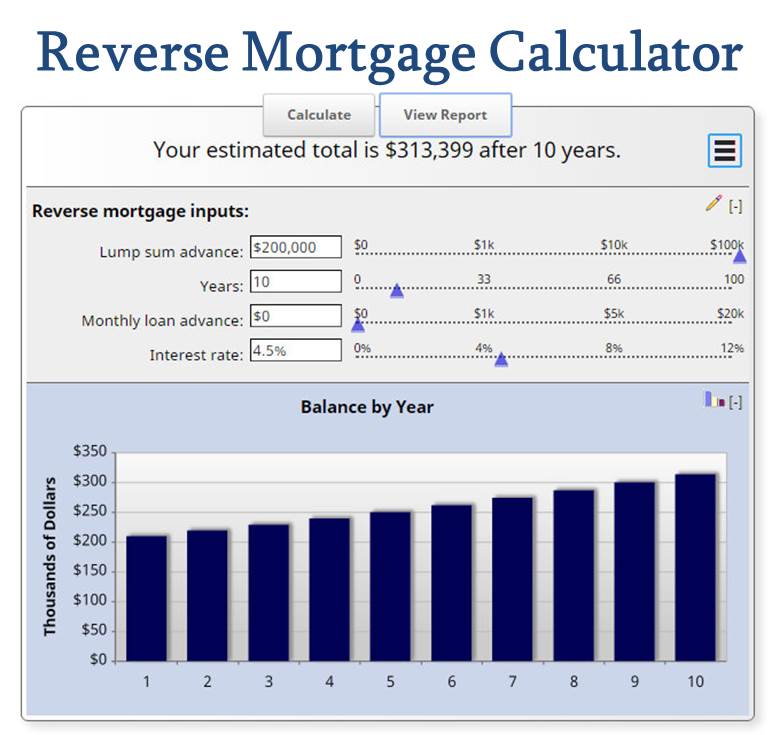

Reverse Mortgage Calculator How Does It Work And Examples

Downloadable Free Mortgage Calculator Tool

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

All In One Interest Only Loan Calculator Financeplusinsurance

Mortgage With Extra Payments Calculator

Mortgage Payoff Calculator With Extra Principal Payment Free Template

Mortgage Calculator With Extra Payments Payment Schedule

![]()

Extra Mortgage Payment Calculator Accelerated Home Loan Payoff Goal

Best 10 Mortgage Calculator Apps Last Updated September 12 2022

Extra Payment Mortgage Calculator Making Additional Home Loan Payments

Reverse Mortgage Calculator Discover If It Makes Sense

Downloadable Free Mortgage Calculator Tool

Extra Payment Mortgage Calculator For Excel

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Mortgage Calculator Money

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Mortgage Calculator With Extra Payments And Lump Sum Excel Template